| • | Voting:Time and Date: 8:00 a.m., Eastern Time, Wednesday, May 18, 2022 Place: Audio webcast at www.virtualshareholdermeeting.com/ELAN2022 Record Date: Close of business on March 21, 2022 Voting: Shareholders as of the record date are entitled to vote; each share of common stock is entitled to one vote for each director nominee and one vote for each of the other proposals Voting Matters and Recommendations Items of Business | | | Board Recommendation | | | Page | 1 | | | Election of the five director nominees to serve three-year terms. | | | “FOR” Each Nominee | | | | 2 | | | Ratification of the appointment of Ernst & Young LLP as Elanco’s independent registered public accounting firm for 2022. | | | “FOR” | | | | 3 | | | Advisory vote on the compensation of Elanco’s named executive officers. | | | “FOR” | | | | 4 | | | Approval of the Elanco Animal Health Incorporated Employee Stock Purchase Plan. | | | “FOR” | | | | 5 | | | Management proposal to amend Elanco’s Articles of Incorporation to eliminate supermajority voting. | | | “FOR” | | | | 6 | | | Management proposal to amend Elanco’s Articles of Incorporation to eliminate legacy parent provisions. | | | “FOR” | | | |

TABLE OF CONTENTS Director Nominees | | Class I Director Nominees | | | | | | | | | | | | | | | | | | | | | | | | | | | | Kapila Kapur Anand | | | Retired Partner, KPMG LLP | | | 68 | | | 2018 | | | | | | | | | | | | | | | | | | | | | | John P. Bilbrey | | | Former Chairman and CEO,

The Hershey Company | | | 65 | | | 2019 | | | | | | | | | | | | | | | | | | | | | | Scott D. Ferguson | | | Founder and Managing Partner,

Sachem Head Capital Management | | | 47 | | | 2020 | | | | | | | | | | | | | | | | | | | | | | Paul Herendeen | | | Former Chief Financial Officer,

Bausch Health | | | 66 | | | 2020 | | | | | | | | | | | | | | | | | | | | | | Lawrence E. Kurzius | | | Chairman and CEO,

McCormick & Company | | | 64 | | | 2018 | | | | | | | | | | | | | | | | | | | | | | Class II Directors — Terms Expiring in 2023 | | | | | | | | | | | | | | | | | | | | | | | | | | | | Michael J. Harrington | | | Former General Counsel,

Eli Lilly and Company | | | 59 | | | 2018 | | | | | | | | | | | | | | | | | | | | | | R. David Hoover

(Chairman) | | | Former Chairman and CEO,

Ball Corporation | | | 76 | | | 2018 | | | | | | | | | | | | | | | | | | | | | | Deborah T. Kochevar | | | Senior Fellow, Fletcher School of Law and Diplomacy, Tufts University | | | 65 | | | 2019 | | | | | | | | | | | | | | | | | | | | | | Kirk P. McDonald | | | CEO, Group M North America | | | 55 | | | 2019 | | | | | | | | | | | | | | | | | | | | | | Class III Directors — Terms Expiring in 2024 | | | | | | | | | | | | | | | | | | | | | | | | | | | | William F. Doyle | | | Executive Chairman, Novocure Ltd. | | | 59 | | | 2020 | | | | | | | | | | | | | | | | | | | | | | Art A. Garcia | | | Former CFO, Ryder System, Inc. | | | 60 | | | 2019 | | | | | | | | | | | | | | | | | | | | | | Denise Scots-Knight | | | Co-Founder and CEO,

Mereo BioPharma Group plc | | | 62 | | | 2019 | | | | | | | | | | | | | | | | | | | | | | Jeffrey N. Simmons | | | President and CEO,

Elanco Animal Health Incorporated | | | 54 | | | 2018 | | | | | | | | | | | | | | | | | | | |

Board Highlights Data as of March 15, 2022. AC = Audit Committee; CC = Compensation Committee; FOC = Finance and Oversight Committee; ISTC = Innovation, Science and Technology Committee; NCGC = Nominating and Corporate Governance Committee TABLE OF CONTENTS Our Corporate Governance Highlights We are committed to the values of effective corporate governance and high ethical standards. As a young public company, we continue to evolve our Board and our corporate governance practices. Many of our changes have been influenced by the valuable feedback we have received from our shareholders and other stakeholders, who provide important external viewpoints that help inform our decisions. For more information about our corporate governance practices, including several enhancements we have made since December 2020, see “Corporate Governance” beginning on page 22 below. | | Independent

Oversight | | | • | | | All directors, including our Board Chairman, are independent except for our CEO | | | | • | | | Four Board Committees – Audit, Compensation, Nominating and Corporate Governance, and Innovation, Science and Technology – are composed entirely of independent directors | | | | • | | | Regular executive sessions of independent directors at Board meetings (chaired by the independent Board Chairman) and Committee meetings (chaired by the independent Committee chairs) without management present | | | | • | | | Active Board and committee oversight of our strategy and risk management, including ESG risks, cybersecurity and human capital management | | | | Board Refreshment

and Practices | | | • | | | Eight new independent directors since 2019 | | | | • | | | Recently created new Innovation, Science and Technology Committee to oversee product innovation and expanded responsibilities of Finance and Oversight Committee | | | | • | | | Comprehensive, ongoing Board succession planning process | | | | • | | | Annual Board and committee self-assessments led by the independent Nominating and Corporate Governance Committee | | | | • | | | Board policy limits director membership on other public company boards | | | | • | | | Continuing director education on key topics and issues | | | | Shareholder

Rights | | | • | | | 3%/3 years proxy access right for shareholders | | | | • | | | One class of outstanding shares with each share entitled to one vote for each director nominee and one vote for each of the other proposals to be voted on |

Voting Matters and Board Recommendations

| | | Matter | Board RecommendationGovernance

Practices | | | • | | | Prohibition on hedging or pledging Elanco stock | | 1. | Election of the four• | | | Clawback policy applicable to directors named in this proxy statementand executives | FOR EACH NOMINEE�� | 2. | Ratification of the appointment of Ernst & Young LLP as the Company’s principal independent auditor for 2019• | FOR | | Rigorous executive stock ownership requirements | | 3. | Non-binding vote on the compensation• | | | Code of named executive officersConduct for directors | FOR | 4. | Non-binding vote on the frequency• | | | Regular review of succession planning for CEO and other key executives | | | | • | | | Annual ESG reporting aligned to key reporting frameworks | | | | • | | | Comprehensive shareholder votes on the compensation of named executive officersengagement program with independent director participation | EVERY YEAR |

ELECTION OF DIRECTORS: Board Nominees

| | | | | | | Name | Age | Director

Since | Committee Memberships | Principal Occupation | | Kapila K. Anand | 65 | 2018 | Audit (Chair) Finance | Retired Partner, KPMG | | John P. Bilbrey | 62 | 2019 | Finance (Chair) Audit | Former CEO and President, The Hershey Co. | | R. David Hoover (Chairman of the Board) | 73 | 2018 | Audit Nominating and Corporate Governance (Chair) | Former CEO, Ball Corp. | | Lawrence Kurzius | 61 | 2018 | Compensation (Chair) Finance | Chair and CEO, McCormick & Company |

DIRECTORS CONTINUING IN OFFICE

Terms expiring in 2020

| | | | | | | Name | Age | Director

Since | Committee Memberships | Principal Occupation | | Michael J. Harrington | 56 | 2018 | Finance | Senior Vice President and General Counsel, Eli Lilly & Company | | Deborah T. Kochevar | 62 | 2019 | Compensation Nominating and Corporate Governance | Provost and Senior Vice President ad interim, Tufts University | | Kirk McDonald | 52 | 2019 | Compensation Nominating and Corporate Governance | Chief Marketing Officer, Xandr, AT&T |

Terms expiring in 2021

| Name | Age | Director

Since | Committee Memberships | Principal Occupation | | Denise Scots-Knight | 59 | 2019 | Compensation Finance | CEO and Co-Founder, Mereo BioPharma Group plc | | Jeffrey N. Simmons | 51 | 2018 | Finance | President and CEO, Elanco Animal Health Incorporated |

ELANCO ANIMAL HEALTH INCORPORATED - 3 2022 Proxy Statement

| 2 | | |

PROPOSAL TO RATIFY THE APPOINTMENTTABLE OF PRINCIPAL Independent AUDITORCONTENTS

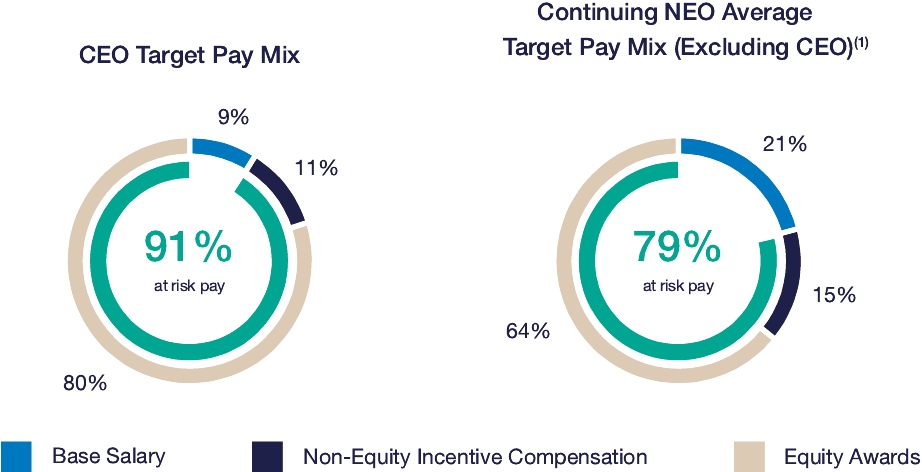

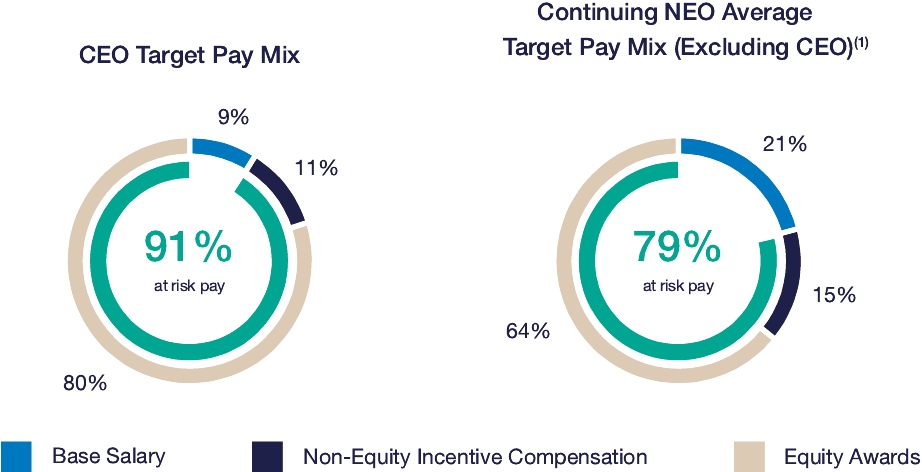

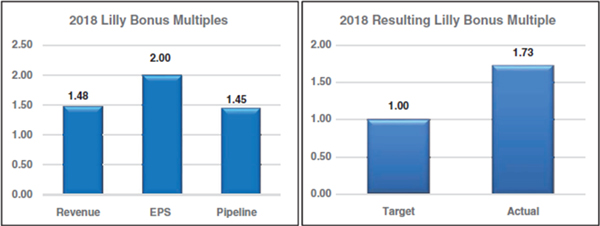

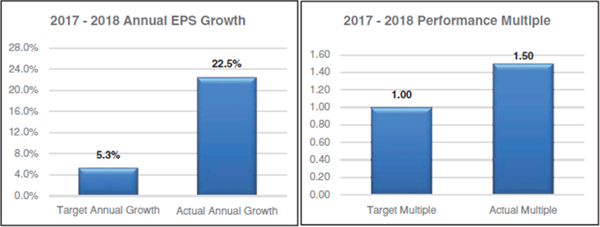

Our Executive Compensation Highlights Our executive compensation programs are designed to help achieve the goals of attracting, engaging, and retaining highly talented individuals who are committed to our core values of integrity, excellence, and respect for 2019Although not required,people, while balancing the long-term interests of shareholders and customers. We accomplish this, in part, by delivering senior executive pay with a greater emphasis on equity and lower weighting on cash to promote an ownership mentality and help ensure shareholder alignment.

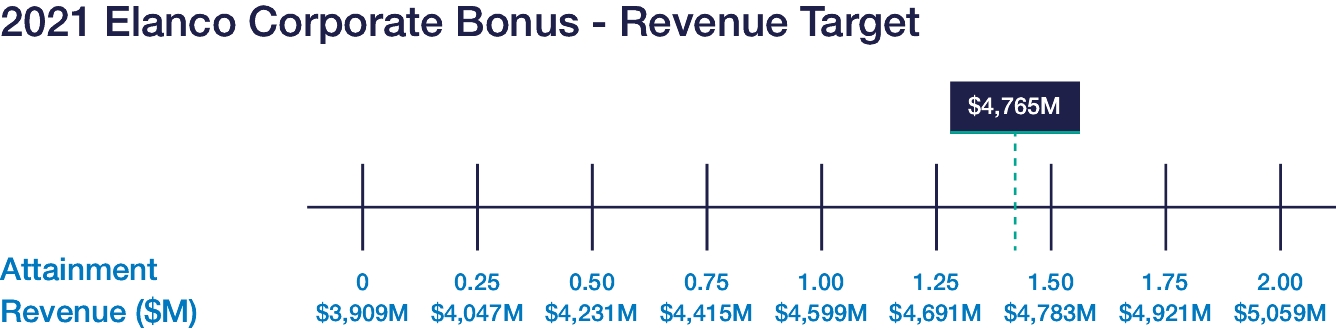

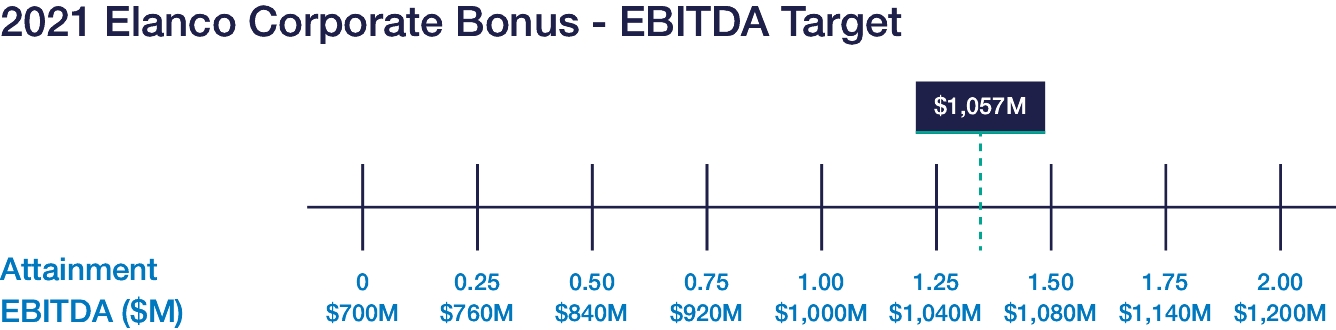

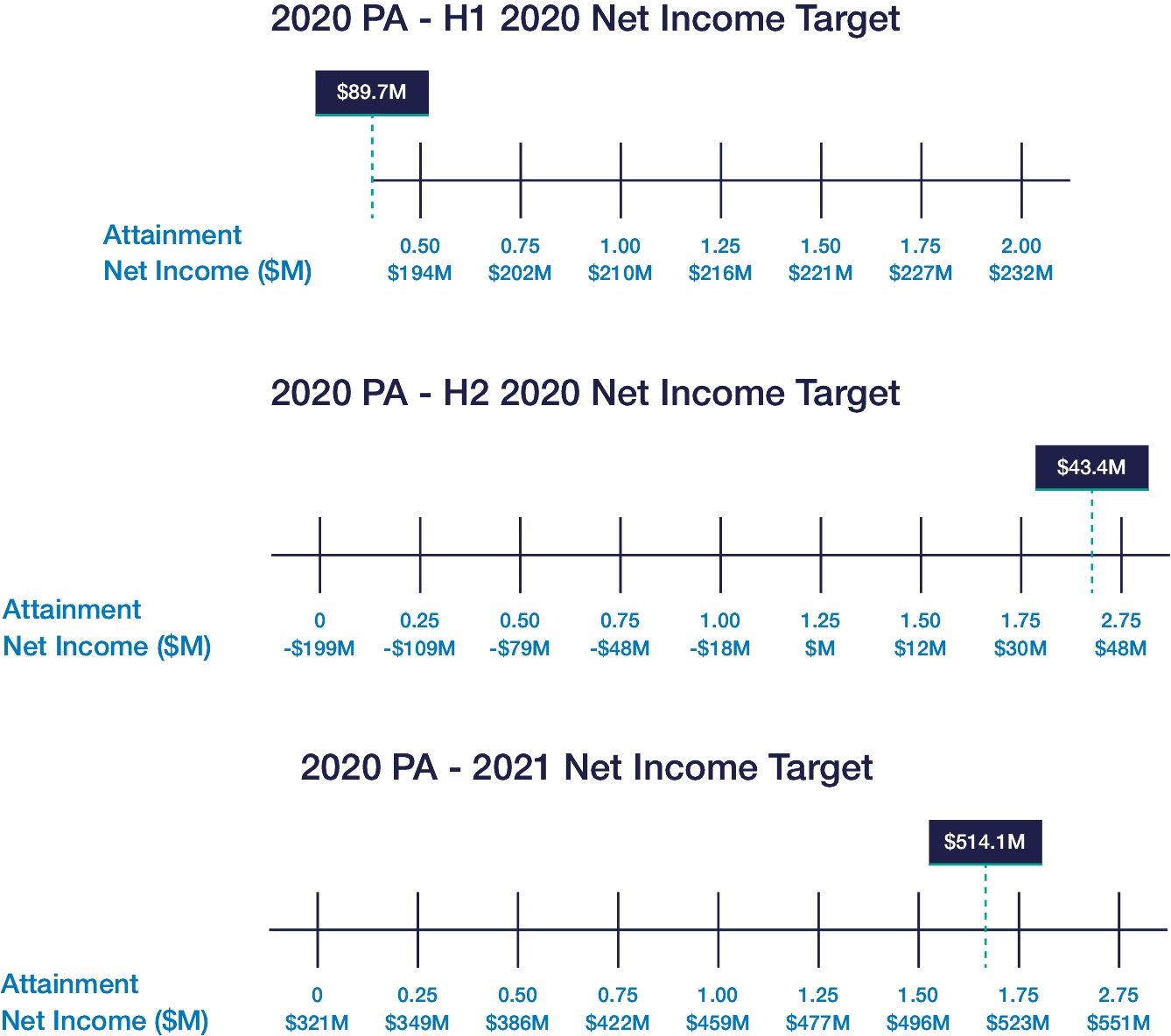

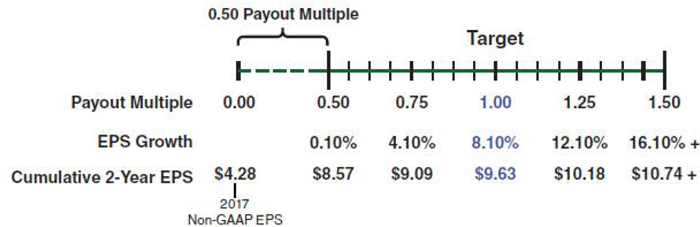

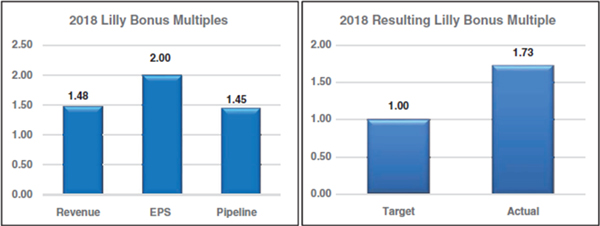

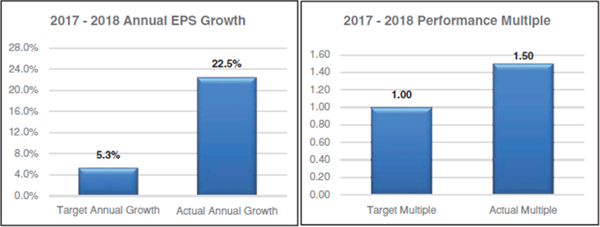

2021 was a transformational year for Elanco. Notwithstanding challenges from inflation, supply chain disruptions, the COVID-19 pandemic, and competition, we are asking shareholderscontinued to ratifybuild a global animal health leader while taking actions to further strengthen our company and our value proposition. In our first full year combined with Bayer Animal Health, our executive compensation was measured against the selection of Ernst & Young LLPfollowing key metrics as well as our principal independent auditorinnovation progress(2):

Given our strong operating performance for 2019.ADVISORY VOTE TO APPROVE COMPENSATION OF Named Executive Officers

Ourthe year, for our participating named executive officers, our annual cash incentive payout for this proxy statement are:

2021 was 132% of target, and our long-term performance awards paid out at 124% of target. For more information, see “Compensation Discussion and Analysis” beginning on page 45. TABLE OF CONTENTS | |

| | | Election of Directors | |

Under our Amended and Restated Articles of Incorporation (our “Articles of Incorporation”), our Board is divided into three classes with approximately one-third of the directors standing for election each year. Our Board currently consists of thirteen directors. The directors hold office for staggered terms of three years (and until their successors are elected and qualified, or until their earlier death, resignation, or removal). One of the three classes is elected each year to succeed the directors whose terms are expiring. The “Class I” directors whose terms expire at the Annual Meeting are Kapila K. Anand, John P. Bilbrey, Scott D. Ferguson, Paul Herendeen, and Lawrence E. Kurzius. Each of these directors has been re-nominated by our Board upon the recommendation of its Nominating and Corporate Governance Committee (the “Nominating and Corporate Governance Committee”). All directors elected at the Annual Meeting will continue in office until the annual meeting of our shareholders to be held in 2025 and until their successors are elected and qualified. The five nominees contribute significantly to our Board, including as follows: All nominees are independent directors; Two of the five nominees were nominated in December 2020 by Sachem Head Capital Management LP (“Sachem Head”), a holder of over 5% of our common stock; Three of the five nominees are or were public company CEOs or CFOs in the pharmaceuticals or consumer products industries; Four of the five nominees have served on other public company boards; and One of the nominees currently serves as the Chair of the Audit Committee of our Board (the “Audit Committee”) and brings deep financial reporting and audit expertise together with knowledge of our financial systems and processes. Each of the directors nominated by our Board has consented to serving as a nominee for the term listed above, to being named in this Proxy Statement, and to serving on our Board if elected. The persons named as proxies solicited by this Proxy Statement will vote the proxies received by them as directed on the proxy card or, if no direction is made, for the election of each of our Board’s five nominees. If any nominee is unable to serve, our Board can either designate a substitute nominee to serve in his or her place as a director or reduce the size of our Board. If our Board nominates another individual, the persons named as proxies may vote for such substitute nominee. Proxies cannot be voted for a greater number of individuals than the five nominees named in this Proxy Statement. Our Board has determined that all director nominees are independent of Elanco and management. See “Corporate Governance—Director Independence” below for more information. Board Membership Criteria Subject to our organizational documents and any operative agreements we may enter into, our Board is responsible for selecting candidates for Board membership and for establishing the general criteria to be used in identifying potential candidates. The Nominating and Corporate Governance Committee leads our director succession planning process and regularly considers the criteria necessary to achieve a diverse Board that provides effective oversight of Elanco. The Nominating and Corporate Governance Committee believes that all directors should display the personal attributes necessary to be effective directors: integrity, sound judgment, intellectual prowess and versatility, confidence, independence in fact and mindset, ability to operate collaboratively, willingness to ask difficult questions, willingness to listen, the ability to commit the necessary time to TABLE OF CONTENTS duties as a director, and commitment to the company, its shareholders and other constituencies. As discussed in “—Board Diversity and Tenure” below, the Nominating and Corporate Governance Committee also seeks to select director candidates who represent a mix of backgrounds and experiences that will enhance the quality of our Board’s deliberations and decisions and believes that Board membership should reflect diversity in its broadest sense, including persons diverse in geography, gender, and ethnicity. Our Corporate Governance Guidelines state that directors shall ensure that existing or future commitments do not materially interfere with their ability to fulfill their responsibilities as Elanco directors, given that serving on our Board requires significant time and attention. In general, directors who are not Elanco employees (“Non-Employee Directors”) may not serve on more than three other public company boards, and our Chief Executive Officer may not serve on more than one other public company board. In addition to the above criteria, the Nominating and Corporate Governance Committee considers, on an ongoing basis, the additional skills, experiences, and backgrounds that it seeks in members of our Board in the context of our business and the existing composition of our Board. The directors’ biographies under “—Our Director Nominees” and “—Other Continuing Directors” below note each director’s relevant skills, experiences, and backgrounds that makes them suited to contribute to our Board.

*

| Data is as of March 15, 2022. |

TABLE OF CONTENTS Our Board and the Nominating and Corporate Governance Committee believe that each of our nominees brings a strong and diverse set of skills, experiences, and perspectives that, when combined with the other continuing directors, creates a high-performing Board that is aligned with our business strategy, and which contributes to the effective oversight of Elanco. The ages, principal occupations, public directorships held, and other information about our nominees and continuing directors are shown below as of March 15, 2022. | | The Board unanimously recommends a vote “FOR” ALL Board nominees listed below. | |

CLASS I DIRECTORS – TERMS EXPIRING AT THE ANNUAL MEETING

Age: 68

Director Since:

September 2018

Board Committees:

Audit (Chair)

Nominating and Corporate Governance

Independent | | | | Kapila Kapur Anand | | | Experience

• Senior advisor, KPMG LLP, one of the world’s leading accounting firms (2016 – 2020); Audit Partner and Advisory Partner (1989 – 2016)

• Elected to KPMG’s U.S. and Americas boards (2005 – 2010) and Chair of the KPMG Foundation

| | | Other Current and Prior Public Company Boards

• Omega Healthcare Investors Inc. (2018 – present)

• Extended Stay America, Inc. and its REIT subsidiary, ESH Hospitality, Inc. (2016 – 2021)

| | | Qualifications

• Deep finance and accounting experience due to over 30 years of service to KPMG, as well as her prior service on the Audit Committees of multiple public companies

• Strong understanding of public company oversight responsibilities, specifically with respect to risk, information security and human capital management developed from her service on public company boards, her engagement as the Chair and Lead Director of the non-profit Women Corporate Directors organization through 2020, and her work as an advisory partner to KPMG’s risk and governance services practice

• Gained business leadership and public policy experience by playing a leading role in the development of KPMG’s private equity and regulatory businesses, as well as acting as an advisory partner to KPMG’s M&A and integration services practices

• Certified Public Accountant

|

TABLE OF CONTENTS

Age: 65

Director Since:

March 2019

Board Committees:

Audit

Finance and Oversight (Chair)

Independent | | | | John P. Bilbrey | | | Experience

• Chairman, The Hershey Company, a global consumer food company (2015 – 2018); Chief Executive Officer and President (2011 – 2017), held other roles of increasing responsibility including as EVP, Chief Operating Officer; President of North America; and President of its International Commercial group

• Held leadership positions at Mission Foods; Danone Waters of North America, Inc.; Bilbrey Farms and Ranch; and Procter & Gamble Company

| | | Other Current and Prior Public Company Boards

• Tapestry, Inc. (2020 – present)

• Campbell Soup Company (2019 – present)

• Colgate-Palmolive Company (2015 – present)

| | | Qualifications

• Long history of successfully building and marketing brands, buying and integrating companies, and growing and leading businesses in the consumer products industry, including 15 years of leadership experience at Hershey and 22 years at The Procter & Gamble Company

• Expertise in overseeing a company’s financial and accounting practices, human capital management, and enterprise risk management developed as Chairman and Chief Executive Officer of a global food products leader

• Unique combination of livestock production, food industry, and consumer insights experience, all of which are highly relevant to our industry, due to service as an owner and operator of commercial cattle operations for Bilbrey Farms and Ranch

• Board-level experience with financial and strategy oversight, corporate governance best practices, and risk and human capital management from service on the Audit Committee at Tapestry, Inc. and the Compensation Committee at Campbell’s Soup Company

|

8 2022 Proxy Statement | ● | Todd S. Young, | |

TABLE OF CONTENTS

Age: 47

Director Since:

December 2020

Board Committees:

Finance and Oversight

Independent | | | | Scott D. Ferguson | | | Experience

• Founder and Managing Partner, Sachem Head, a private investment management firm (2012 – present)

• Served as the first investment professional at Pershing Square Capital Management, L.P., a private investment management firm (2001 – 2012)

• Vice President, American Industrial Partners, a private equity firm (1999 – 2001)

• Business analyst, McKinsey & Company (1996 – 1999)

| | | Other Current and Prior Public Company Boards

• Olin Corporation (2020 – present)

• Autodesk Inc. (2016 – 2017)

| | | Qualifications

• Extensive finance and accounting skills and the perspective of one of our largest shareholders gained as the founder of Sachem Head

• Strong relationships in the investment community

• Track record of working collaboratively with management teams, including at Zoetis Inc., an animal health company

• Critical insight on our business and operations as well as the issues we face

• Significant experience with strategy and risk management oversight as well as with corporate governance gained through service on other public company boards

|

TABLE OF CONTENTS

Age: 66

Director Since:

December 2020

Board Committees:

Finance and Oversight

Independent | | | | Paul Herendeen | | | Experience

• Advisor to the Chairman and Chief Executive Officer, Bausch Health Companies Inc., a global health care products company (2021 – 2022); Executive Vice President and Chief Financial Officer (Chief(2016 – 2021)

• Executive Vice President and Chief Financial Officer, since November 1, 2018)Zoetis Inc., an animal health company (2014 – 2016)

• Chief Financial Officer, Warner Chilcott, a specialty pharmaceuticals company

(1998 – 2001; 2005 – 2013)

• Executive Vice President and Chief Financial Officer, MedPointe Pharmaceuticals, a privately-held pharmaceutical company

• Principal investor, Dominion Income Management and Cornerstone Partners

• Held various positions with the investment banking group of Oppenheimer & Company and the capital markets group of Continental Bank Corporation

• Senior auditor, Arthur Andersen & Company

| | | Qualifications

• Extensive understanding of complex financial and accounting issues and reporting relevant to a global business in our industry developed through decades of experience in finance and accounting in the life sciences industry, including service as the Chief Financial Officer of Zoetis Inc.

• Substantial expertise with budgeting, accounting controls, internal audit, financial forecasting, strategic financial planning and analysis, and capital expenditure management gained while at Bausch Health Companies Inc., where his disciplined financial approach and strong operational focus helped the company reduce its debt and strengthen its balance sheet

• Significant M&A and business development experience from his tenure at Warner Chilcott, Zoetis, and Bausch Health as well as his nearly decade of experience as a principal investor at Dominion Income Management and Cornerstone Partners, where he worked on investments as well as mergers & acquisitions for the firms and their portfolio companies

• Institutional investor perspective developed through his more than 15 years of experience engaging with the financial community as a public company Chief Financial Officer and leader of award-winning investor relations programs

|

10 2022 Proxy Statement | | | |

TABLE OF CONTENTS

Age: 64

Director Since:

September 2018

Board Committees:

Compensation (Chair)

Nominating and Corporate Governance

Independent | | | | Lawrence E. Kurzius | | | Experience

• President and Chief Executive Officer, McCormick & Company, a global Fortune 500 food company (2016 – present); Chairman of the Board (2017 – present)

• Has held various leadership roles, including as President and Chief Operating Officer; Chief Administrative Officer; President, International Businesses; President, Europe, Middle East and Africa; and President, U.S. Consumer Foods

| | | Other Current and Prior Public Company Boards

• McCormick & Company (2015 – present)

| | | Qualifications

• Valuable mix of global business expertise and risk management and sustainability oversight gained from broad executive experience at McCormick

• Deep understanding of human capital management issues developed through leadership of a company with over 14,000 employees globally

• Marketing and brand building insights gained from experience at McCormick as well as prior leadership roles at Mars Inc. and the Quaker Oats Co.

• Significant corporate governance experience from which he provides a broad perspective on issues facing public companies, especially in the areas of executive compensation and leadership development

• Serves on the boards of multiple not-for-profit industry groups, including The Consumer Goods Forum, The Consumer Brands Association, and The National Association of Manufacturers

• Member of Business Roundtable, an association of chief executive officers of leading companies working to promote a thriving U.S. economy and expanded opportunity through sound public policy

|

11 2022 Proxy Statement | | | |

TABLE OF CONTENTS Other Continuing Directors CLASS II DIRECTORS – TERMS EXPIRING IN 2023

Age: 59

Director Since:

September 2018

Board Committees:

Innovation, Science

and Technology

Independent | | | | Michael J. Harrington | | | Experience

• Senior Vice President, General Counsel, Lilly (2013 – 2020); Vice President and Deputy General Counsel of Global Pharmaceutical Operations (2010 – 2012); Vice President and General Counsel, Corporate (2004 – 2010); managing director of Lilly’s New Zealand affiliate

| | | Qualifications

• Operational and strategic acumen in the animal health industry with expertise in legal and public policy issues, government and regulatory affairs, intellectual property, risk management, corporate governance, and compliance gained from experience at Lilly, one of the world’s leading global pharmaceutical companies and our former parent company

• Digital and cybersecurity expertise developed through his prior oversight of Lilly’s information security program

• Ability to oversee M&A and business development activities due to prior experience executing numerous transactions while at Lilly, including playing a leading role in the separation of Elanco from Lilly and subsequent listing of Elanco on the New York Stock Exchange (the “NYSE”) as an independent public company solely dedicated to animal health

|

12 2022 Proxy Statement | | | |

TABLE OF CONTENTS

Age: 76

Director Since:

September 2018

Board Committees:

Compensation

Nominating and Corporate Governance (Chair)

Independent | | | | R. David Hoover | | | Experience

• 41-year leadership career at Ball Corporation, one of the world’s leading suppliers of aluminum packaging for the beverage, personal care and household products industries as well as a provider of aerospace and other technologies, where he served as Chairman (2002 – 2011); Chief Executive Officer (2001 – 2011); President (2000 – 2010); Chief Operating Officer (2000 – 2001); and Vice Chairman and Chief Financial Officer

(1998 – 2000)

| | | Other Current and Prior Public Company Boards

• Edgewell Personal Care (and its predecessor company, Energizer Holdings, Inc.)

(2000 – 2021)

• Eli Lilly and Company (2009 – 2018)

• Ball Corporation (1996 – 2018)

• Steelcase Inc. (2012 – 2016)

| | | Qualifications

• Deep understanding of leading global businesses, human capital management, financial and accounting practices, risk management, and business development gained from leading Ball Corporation for over four decades

• Effective oversight of the company’s strategy and significant risks and leadership skills developed during service on numerous public company boards, including on audit and governance committees

• Insight into the animal health industry as well as life sciences and consumer products companies generally gained from his tenure on the boards of directors of Lilly, Ball Corporation and Edgewell Personal Care (Energizer Holdings)

|

13 2022 Proxy Statement | | | |

TABLE OF CONTENTS

Age: 65

Director Since:

March 2019

Board Committees:

Innovation, Science and Technology (Chair)

Nominating and Corporate Governance

Independent | | | | Deborah T. Kochevar, D.V.M., Ph.D, DACVCP | | | Experience

• Senior Fellow, The Fletcher School of Law and Diplomacy and Dean Emerita, Cummings School of Veterinary Medicine; Tufts University (2019 – present); Provost and Senior Vice President ad interim (2018 – 2019); Dean of the Cummings School of Veterinary Medicine (2006 – 2018)

• Long-time faculty member and administrator, College of Veterinary Medicine and Biomedical Sciences at Texas A&M University, held the Wiley Chair of Veterinary Medical Education

| | | Other Current and Prior Public Company Boards

• Charles River Laboratories International, Inc. (2008 – present)

| | | Qualifications

• Valuable insights due to medical and scientific expertise, knowledge of the animal health industry, and the scientific nature of our key research and development initiatives gained through her distinguished academic career, including as Dean of one of the world’s leading veterinary schools and her track record of publications in peer-reviewed research and teaching journals

• Public policy acumen due to her experience with various government entities and her expertise in articulating evidence-based science with international aspects of inter-professional education, clinical and translational research, and global One Health diplomacy

��� Public company corporate governance experience due to her service on the board of Charles River Laboratories, where she chairs the company’s Nomination and Corporate Governance Committee and serves as a member of the Science and Technology Committee

• Understanding of quality veterinary practices and the needs of scientists and the research and development community helps us mitigate and manage key risks, including those identified as most relevant to our industry under the Sustainability Accounting Standards Board (“SASB”) standards

|

14 2022 Proxy Statement | | | |

TABLE OF CONTENTS

Age: 55

Director Since:

March 2019

Board Committees:

Compensation

Innovation, Science and Technology

Independent | | | | Kirk P. McDonald | | | Experience

• Chief Executive Officer and member of Global Leadership Team, GroupM North America, a global provider of media and advertising solutions through the development of technology-enabled services (August 2020 – present)

• Chief Business Officer, AT&T's advertising division, Xandr (September 2019 – August 2020); Chief Marketing Officer (November 2018 - September 2019)

• Leadership roles at several other leading companies, including President, PubMatic; President of Digital, Time Inc.; Chief Advertising Officer, Fortune|Money Group; and Senior Vice President of Network Sales, DRIVEpm and Atlas (both units of Microsoft's advertising business)

| | | Qualifications

• Significant marketing, brand management, innovation, and consumer products experience, as well as experience with digital and emerging technologies provided by more than 30 years of experience in marketing and general management leadership roles

• Insights into managing talent in large organizations in fast-growing industries gained as Chief Executive Officer of GroupM North America, an organization of approximately 6,500 people

• Deep domain expertise in the intersection between marketing and technology recognized by AdWeek who named him one of the “50 vital leaders in tech, media and marketing”

• Member of the Executive Leadership Council and serves as a director of several private and non-profit companies

|

15 2022 Proxy Statement | | | |

TABLE OF CONTENTS CLASS III DIRECTORS – Terms Expiring in 2024

Age: 59

Director Since:

December 2020

Board Committees:

Finance and Oversight

Innovation, Science and Technology

Independent | | | | William F. Doyle | | | Experience

• Executive Chairman, Novocure Ltd., a commercial stage oncology company (2016 – present)

• Managing director, WFD Ventures LLC, a private venture capital firm he co-founded (2002 – present)

• Member of the investment team, Pershing Square Capital Management, L.P. (2014 – 2016)

• Member of Medical Devices and Pharmaceutical Group Operating Committee, Johnson & Johnson; Vice President, Licensing and Acquisitions; Chairman of the Medical Devices Research and Development Council, Worldwide President of Biosense-Webster, Inc., member of the boards of Cordis Corporation and Johnson & Johnson Development Corporation, Johnson & Johnson’s venture capital subsidiary

• Served as a management consultant, McKinsey & Company

| | | Other Current and Prior Public Company Boards

• Minerva Neurosciences, Inc. (2017 – present)

• Novocure Ltd. (2004 – present)

• OptiNose, Inc. (2004 – 2020)

• Zoetis Inc. (2015 – 2016)

| | | Qualifications

• Strategic and operational experience, particularly in the animal health and life sciences industries, gained through his service as a director of Zoetis and in roles of increasing responsibility at Johnson & Johnson

• Experience with growing companies illustrated by Novocure growing revenue by over $500 million and increasing adjusted EBITDA by hundreds of millions of dollars since its initial public offering in 2015 while he served as Executive Chairman

• Broad understanding of new technologies and emerging business models and risks through his service as managing director of WFD Ventures

• Deal making oversight and experience managing innovation programs gained through his tenure at Johnson & Johnson

• Valuable board-level experience from his years of service on the boards of Zoetis Inc. and several other public and private companies

|

16 2022 Proxy Statement | | | |

TABLE OF CONTENTS

Age: 60

Director Since:

May 2019

Board Committees:

Audit

Finance and Oversight

Independent | | | | Art A. Garcia | | | Experience

• Served in various leadership roles at Ryder System, Inc., primarily a North American provider of transportation and supply chain management products known for its fleet of rental trucks, including as its Executive Vice President and Chief Financial Officer

(2010 – 2019); Senior Vice President and Controller (2005 – 2010); and Vice President and Controller (2002 – 2005)

| | | Other Current and Prior Public Company Boards

• American Electric Power Company, Inc. (2019 – present)

• ABM Industries Incorporated (2017 – present)

| | | Qualifications

• Senior leadership, financial, operational, and human capital management expertise through his experience leading the finance organization at Ryder, where he led the re-engineering of the organization to help drive efficiency, established a new business model, and implemented strategies to revitalize growth and improve profitability

• Experience with financial risk issues and public company governance practices developed from roles at Ryder, as well as his service to the audit, risk management and governance committees of other public companies

• Oversaw corporate strategy and business development functions and managed the financial integration of 12 acquisitions, which allows him to assist with the oversight of these areas at Elanco

|

17 2022 Proxy Statement | | | |

TABLE OF CONTENTS

Age: 62

Director Since:

March 2019

Board Committees:

Compensation

Innovation, Science and Technology

Independent | | | | Denise Scots-Knight | | | Experience

• Co-Founder, Chief Executive Officer and Director, Mereo BioPharma Group plc, an international biopharmaceutical company focused on oncology and rare diseases

(2015 – present)

• Managing Partner, Phase4 Partners Ltd., a privately held, global life science venture capital firm (2010 – 2015)

• Head, Nomura Phase4 Ventures, a venture capital affiliate of Nomura International plc, a leading Japanese financial institution (2004 – 2010)

| | | Other Current and Prior Public Company Boards

• Mereo BioPharma Group plc (2015 – present)

| | | Qualifications

• Experience with global strategic oversight and talent and leadership development in a growth-oriented industry gained through her service as Co-Founder and Chief Executive Officer of Mereo BioPharma Group plc, a United Kingdom-based, NASDAQ-listed company with operations in the U.S., as well as through leadership roles in other non-U.S. organizations

• Named one of the 15 leading women in European biotech by Labiotech UG

• Helps communicate shareholder perspectives to our Board through her extensive experience in the life sciences venture capital and investment industry

• Keen acumen and technical expertise to the oversight of our research and development activities developed through career track record building new innovation models and strategic partnerships for emerging technologies

• Served as a director of several public and privately held biotech and life sciences companies

|

18 2022 Proxy Statement | | | |

TABLE OF CONTENTS

Age: 54

Director Since:

September 2018

Board Committees:

Finance and Oversight | | | | Jeffrey N. Simmons | | | Experience

• President and Chief Executive Officer, Elanco (2018 – present), Senior Vice President and President of the Elanco Animal Health division at Lilly (2008 – 2018); held various leadership roles in Elanco Animal Health as a division of Lilly, including International Marketing Manager, Country Director for Brazil, Area Director for Western Europe, and Executive Director for U.S. and Global Research & Development

| | | Qualifications

• Proven, purpose-driven leader with 30 years of industry and life sciences experience, including as the head of Elanco for the past decade, where he directed our transformation from a primarily US feed additive company to a premier global leader with a diversified business, more than quadrupled our revenue, created a unique innovation engine, and built five new businesses, including a $2.5 billion pet health business and a leading aquaculture business

• Top-tier M&A and business development experience, having orchestrated our separation from Lilly and subsequent listing on the NYSE, as well as the industry’s largest acquisition, our 2020 acquisition of Bayer Animal Health

• Significant business leadership, strategic insights, product marketing expertise, risk management and human capital management skills. Under his leadership, we have become a more diverse, durable, and global company with greater reach and scale, with an important balance between pet health and farm animal and US and international markets. We have added capabilities, built more comprehensive portfolios, and stand as an omnichannel leader with significant presence both in the veterinary clinic and in retail, including e-commerce

• With his commitment to sustainability, under his leadership, we deepened our commitment to sustainability and, in October 2020, became the first independent animal health company to launch sustainability commitments connected to the United Nations Sustainable Development Goals

• Decades of experience overseeing research and development programs, including the successful product launch of numerous animal health blockbuster drugs gained through his service as Executive Director for U.S. and Global Research & Development as well as other senior leadership roles within Elanco

• International perspective developed through both his global management across our business and in his role as the former President of the International Federation for Animal Health (IFAH), the worldwide organization representing the manufacturers of veterinary medicines

|

19 2022 Proxy Statement | | | |

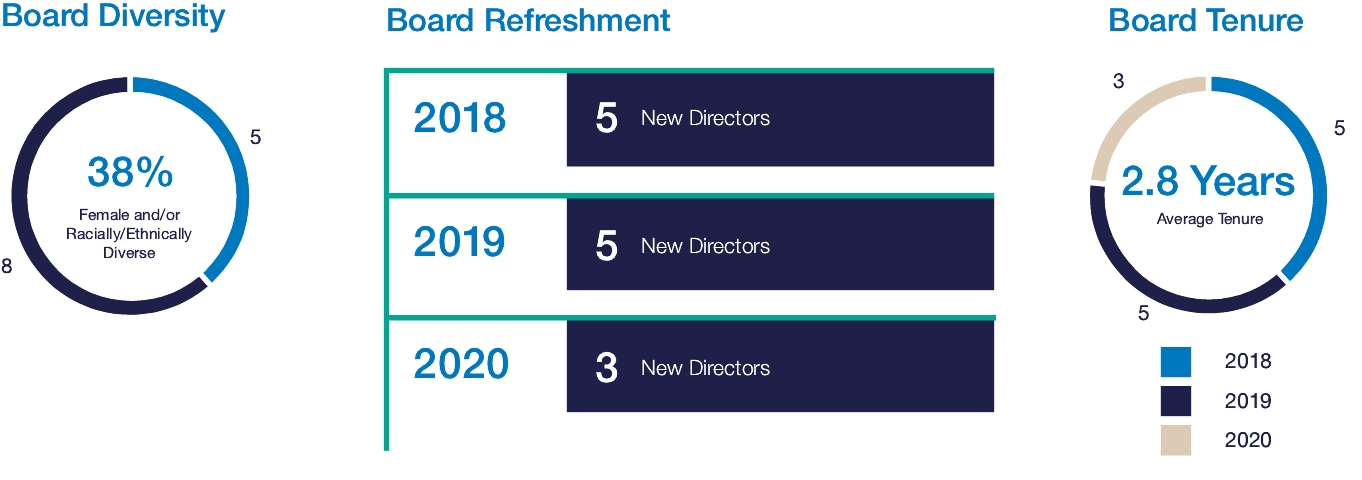

TABLE OF CONTENTS Director Nomination Process The Nominating and Corporate Governance Committee makes recommendations to our Board for nominations; identifies and screens potential new candidates, including by reviewing recommendations from other directors, management and shareholders; and assesses the ongoing contributions of incumbent directors whose terms are expiring with input from all other directors. The Nominating and Corporate Governance Committee may also retain search firms to assist in identifying and screening candidates. The Nominating and Corporate Governance Committee will consider director candidates recommended by a shareholder in the same manner as all other candidates recommended by other sources. A shareholder may recommend a candidate at any time of the year by writing to our Corporate Secretary at the contact details set forth in “Other Information—Communicating With Us” below. Beginning with our 2023 annual meeting of shareholders (the “2023 Annual Meeting”), a shareholder, or group of up to 20 shareholders, owning 3% or more of our outstanding common stock continuously for at least three years, may submit director nominees for up to two individuals or 20% of our Board (whichever is greater) for inclusion in our proxy statement if the shareholder(s) and the nominee(s) meet the requirements in our Bylaws. See “Submission of Shareholder Proposals or Nominations–Director Nominations (Including Proxy Access Nominations) or Other Proposals for Presentation at the 2023 Annual Meeting” below for more information. Board Diversity and Tenure Our Board is committed to building a Board with diverse experiences and backgrounds. Our Corporate Governance Guidelines state that our Board will select director candidates who represent a mix of backgrounds and experiences that will enhance the quality of our Board’s deliberations and decisions, and that Board membership should reflect diversity in its broadest sense, including persons diverse in geography, gender, and ethnicity. Additionally, the charter of our Nominating and Corporate Governance Committee states that the committee will actively consider for selection as directors those persons who are diverse in experience, ideas, gender, race and ethnicity. Given that we only recently became a stand-alone public company after our separation from Lilly, our Board is relatively short-tenured. Five of our directors joined our Board just prior to our initial public offering in September 2018, with five additional directors joining in March 2019, when Lilly exited its remaining ownership in Elanco. In December 2020, we added William Doyle, Scott Ferguson, and Paul Herendeen to our Board to strengthen the financial and industry-specific expertise on our Board and to help drive our innovation and improve our operations. Consequently, as of March 15, 2022, the five directors we have nominated for election at the Annual Meeting have an average tenure of 2.5 years, and our full Board has an average tenure of 2.8 years. Our Corporate Governance Guidelines state that there is no limit on the number of terms for which a director may be elected, and that our Board does not endorse arbitrary term limits on directors’ service. However, our Corporate Governance Guidelines also states that our Board does not believe in automatic re-nomination of directors, and that the annual self-evaluation process described in “—Board Evaluations” below will be an important determinant for continuing service.

20 2022 Proxy Statement | | | |

TABLE OF CONTENTS In the spirit of our values of excellence and continuous improvement, our Board is committed to regular assessments of itself and its committees. This helps ensure that our Board’s governance and oversight responsibilities are well executed and updated to reflect best practices. At the end of each quarterly Board meeting, our Board meets in executive session, both with and without our Chief Executive Officer, to discuss whether the meeting’s objectives were satisfied and to identify issues that might require additional dialogue. Each of our Board’s standing committees also regularly meets in executive session for the same purposes. Each year, our Board conducts an annual self-evaluation process, which is led by the independent Chairman of our Board and the Nominating and Corporate Governance Committee. Each director completes a comprehensive questionnaire evaluating the performance of our Board as a whole and the committees on which the director serves. The directors’ responses are aggregated and anonymized to encourage the directors to respond candidly and maintain the confidentiality of their responses. The full results are reviewed by the Nominating and Corporate Governance Committee and summarized for the full Board, which reviews the results in executive session. Each Board committee also separately reviews the feedback received for such committee in executive session. We believe this annual evaluation process provides our Board and its committees with valuable insight regarding areas where our Board believes it functions effectively as well as areas where our Board can improve. Recommendations for improvement derived from the annual evaluation process are used to adjust our Board’s future agendas and practices. 21 2022 Proxy Statement | | | |

TABLE OF CONTENTS We are committed to the values of effective corporate governance and high ethical standards. We believe these values are conducive to long-term performance. We believe our key corporate governance and ethics policies help us manage our business in accordance with the highest standards of business practice and in the best interests of our shareholders. Our Corporate Governance Guidelines and committee charters help govern the operation of our Board and its committees. These are reviewed at least annually by the Nominating and Corporate Governance Committee and the full Board and are updated periodically in response to changing regulatory requirements, evolving practices, issues raised by our shareholders and other stakeholders, and otherwise as circumstances warrant. Recent Corporate Governance Enhancements In the spirit of our values of excellence and continuous improvement, our Board is committed to regular assessments of itself and its committees. This helps ensure that our Board’s governance and oversight responsibilities are well executed and updated to reflect best practices. Our Board continuously evaluates our governance-related practices, taking into account evolving best practices, the needs of our business, and feedback we receive from our shareholders and other stakeholders, including as described in “—Shareholder Feedback” below. Since December 1, 2020, due in part in response to this feedback, we have made the following enhancements: | | • | | | We established a new Board committee, the Innovation, Science and Technology Committee (the “Innovation, Science and Technology Committee”), to focus on advancing and augmenting our product pipeline innovation and driving research and development optimization. This committee is chaired by Dr. Deborah T. Kochevar, Dean Emerita of Cummings School of Veterinary Medicine at Tufts University, one of the world’s leading veterinary schools. | | | | • | | | We expanded the responsibilities of the Finance and Oversight Committee of our Board (the “Finance and Oversight Committee”) to focus on M&A integration, financial matters and margin expansion, operational initiatives, and related areas of oversight. | | | | • | | | We continued to refresh our Board by appointing three new independent directors: William F. Doyle, a distinguished health care executive, animal health director and investor; Scott Ferguson, the managing director of Sachem Head, one of our largest shareholders; and Paul Herendeen, the former chief financial officer of Bausch Health. These directors have strengthened our Board through a willingness to provide a shareholder perspective, constructive engagement and commitment to our progress, and operational and industry-specific expertise. In all, we have added eight new independent directors since the beginning of 2019. | | | | • | | | In June 2021, we enhanced our governance reporting related to environmental, social and governance (“ESG”) matters through the release of our 2020 Environmental, Social & Governance Summary (the “2020 ESG Summary Report”), which is aligned with SASB standards and the Task Force on Climate-related Financial Disclosures (“TCFD”) reporting frameworks and includes other topics we believe are relevant to our key stakeholders. | | | | • | | | We expanded our shareholder engagement program through an ESG roadshow in the second half of 2021, through which members of our Board and executive leadership engaged with shareholders holding 45% of our shares (as of June 30, 2021) on a variety of topics related to executive compensation and ESG matters. | |

22 2022 Proxy Statement | | | |

TABLE OF CONTENTS | | • | | | In 2022, we adopted a “proxy access” bylaw, whereby beginning with the 2023 Annual Meeting, a shareholder, or group of up to 20 shareholders, owning 3% or more of our outstanding common stock continuously for at least three years, can submit director nominees for up to two individuals or 20% of our Board (whichever is greater) for inclusion in our proxy statement subject to certain customary limitations. | | | | • | | | We are submitting two management proposals, for shareholder approval at the Annual Meeting, to eliminate the supermajority provisions and certain other legacy provisions in our Articles of Incorporation (Proposal No. 5 and Proposal No. 6). | |

We believe these enhancements help demonstrate our responsiveness to shareholder feedback and commitment to good governance. We and our Board are committed to continuing to drive progress regarding our governance and look forward to continuing our dialogue with our shareholders and other stakeholders on these topics. Board Leadership Structure Since our spin-off from Lilly, we have always separated the roles of Board Chairman and Chief Executive Officer. As described in our Corporate Governance Guidelines, our Board currently has a strong, independent, non-executive chairman, R. David Hoover, which we believe helps further strengthen our governance structure. Our Board believes this provides an effective leadership model for Elanco and our Board to help assure effective independent oversight at this time. However, our Board also believes that no single leadership model is right for all companies and at all times. Depending on the circumstances, other leadership models, such as combining the roles of the Board Chairman and Chief Executive Officer, might be appropriate. Our Board periodically reviews its leadership structure and will continue to evaluate and implement the leadership structure that it concludes most effectively supports our Board in fulfilling its responsibilities. In addition to the leadership of our Board Chairman, our independent directors have ample opportunity to, and regularly do, assess the performance of our Chief Executive Officer and provide meaningful direction to him. Our Board has strong and effective independent oversight of management. | | • | | | 92% of our Board members (including all director nominees) are independent; | | | | • | | | Each member of the Audit Committee and Nominating and Corporate Governance Committee, as well as the Compensation Committee of the Board (the “Compensation Committee”), is independent; | | | | • | | | Each of the chairs of our Board’s five standing committees is independent; | | | | • | | | Board and committee agendas are prepared by their independent chairs, based on discussions with all directors and recommendations from senior management; and | | | | • | | | All directors are encouraged to request agenda items, additional information and/or modifications to schedules as they deem appropriate. | |

OUR BOARD’S OVERSIGHT OF RISK MANAGEMENT We have an enterprise risk management program overseen by our Chief Compliance Officer, who is supported by our internal General Auditor. Material enterprise risks, which include competitive, strategic, operational, financial, legal, regulatory, and ESG risks, are identified and prioritized by management through both top-down and bottom-up processes. Our management is charged with managing these risks through robust internal processes and controls. 23 2022 Proxy Statement | | | |

TABLE OF CONTENTS Our full Board has responsibility for oversight of our management’s planning for material risks. Our enterprise risk management program is reviewed annually at a full Board meeting, and enterprise risks are also addressed in periodic business function reviews. Reviews of certain risk areas are also conducted by relevant Board committees, as described below. | | Our Board: | | | Our Board considers significant enterprise risk topics, including risks associated with competition, innovation, market access, corporate and brand reputation management, information security and data privacy, and business continuity.

In addition, our Board receives regular reports from members of our senior leadership team that includes discussions of the risks involved in their respective areas of responsibility.

Our Board is routinely informed of developments that could affect our risk profile or other aspects of our business.

Our Board is kept informed of its committees’ risk oversight and other activities through reports by the committee Chairs to the full Board, which occur at each regularly-scheduled quarterly Board meeting. | | | | Audit Committee: | | | The Audit Committee oversees the management of risks related to financial matters, particularly financial reporting and disclosure, accounting, and internal controls, as well as risks related to our audit and regulatory functions.

The Audit Committee also oversees our program, policies, and procedures related to information asset security, and data protection as it relates to financial reporting and internal controls, including data privacy and network security. See “—Our Board’s Oversight of Cybersecurity” below for more information. | | | | Compensation Committee: | | | The Compensation Committee oversees the management of risks related to our compensation programs, including our conclusion that our compensation policies and practices do not create risks that are reasonably likely to have a material adverse effect on Elanco. | | | | Finance and Oversight Committee: | | | The Finance and Oversight Committee oversees issues related to financial risk management, including oversight of our financial risk management policies, as well as oversight of risks associated with liquidity, the investment performance of benefit plans, tax strategies, currency and interest rate exposures. | | | ��� | Innovation, Science and Technology Committee: | | | The Innovation, Science and Technology Committee oversees the management of risks associated with our research and development program, risks related to competitive or disruptive technologies, and risks related to technologies which we are acquiring or in which we are investing. | | | | Nominating and Corporate Governance Committee: | | | The Nominating and Corporate Governance Committee oversees risks relating to public policy issues, including our lobbying priorities and activities. The committee also oversees risks arising from our ESG practices as well as corporate responsibility and sustainability initiatives. For more information about the role of this Committee and our Board in providing oversight and guidance for our sustainability program, see “—Sustainability and ESG Program—ESG Program Governance” below. | | | | Management: | | | Management is primarily responsible for identifying risk and risk controls related to significant business activities and mapping the risks to our strategy. Management is also responsible for developing programs and recommendations to determine the sufficiency of risk identification, the balance of potential risk to potential reward, and the appropriate manner in which to manage risk. | |

24 2022 Proxy Statement | | | |

TABLE OF CONTENTS OUR BOARD’S OVERSIGHT OF STRATEGY Our Board and its committees are involved in overseeing our corporate strategy, including major business, organizational and transformational initiatives; capital allocation priorities; and significant acquisitions and other transactions as well as related integration issues. Our Board engages in robust discussions regarding our corporate strategy at nearly every Board meeting. Our Board’s committees oversee elements of our strategy associated with their respective areas of responsibility. Additionally, our Board and management continue to evaluate risks to our business, employee and customers related to the ongoing COVID-19 pandemic. We continue to prioritize the safe, continued operation of our manufacturing sites and research and development facilities, as well as ensuring there are no material constraints to our ability to obtain the raw materials, distribute products, or otherwise operate our business in light of ongoing travel and other restrictions. OUR BOARD’S OVERSIGHT OF HUMAN CAPITAL AND SUCCESSION PLANNING Our approximately 9,000 global employees help shape the Elanco culture and everything we do for our customers. The Elanco Employee Promise states that together, we foster an inclusive culture where everyone can make a difference, encouraging ownership, growth, and well-being, while focusing on customers and the animals in their care. Our Board’s committees oversee elements of our culture associated with their area of responsibility. For instance, the Compensation Committee is kept informed of our compensation practices, including pay equity, through recurring updates. The Compensation Committee is responsible for periodically discussing with our management and evaluating our performance in the development, implementation, and effectiveness of our policies and strategies related to human capital management and diversity in our workforce. The Audit Committee is responsible for oversight of our ethics and compliance program and regularly receives updates on our culture of integrity and the tone set by leaders throughout the organization. Succession planning for our senior leadership positions is critical to our success. The Compensation Committee reports to our Board on succession planning and leadership development for our Chief Executive Officer as well as certain other executive positions. This topic is discussed formally at least once per year and is also discussed regularly in executive session. The Nominating and Corporate Governance Committee is tasked with focusing on director succession planning. In performing this function, the committee is responsible for recruiting and identifying nominees for election as directors to our Board. OUR BOARD’S OVERSIGHT OF CYBERSECURITY We prioritize the trust and confidence of our customers and workforce. Our dedicated Chief Information Security Officer is responsible for leading an information security team that helps prevent, identify, and appropriately address cybersecurity threats. The team focuses on developing and implementing strategies and processes to protect the confidentiality, integrity, and availability of our assets. As a stand-alone company since our spin-off from Lilly in 2018, we have been building a risk-based, fit-for-purpose, and innovative information security program. Our information security architecture is designed to accept and embrace the realities of modern working with a cloud heavy footprint and extended remote workforce. Overall, our program leverages and aligns with various frameworks and good practices including the National Institute of Standards and Technology (NIST) Cyber Security Framework, ISO 27000 family of Standards, Information Technology Infrastructure Library (ITIL) Processes, and other good practice control methods. We expect to continue to mature and enhance our information security program as we progress. The Audit Committee oversees our program, policies, and procedures related to information asset security, and data protection as it relates to financial reporting and internal controls, including data privacy and network security. Broad oversight is maintained by our full Board. The Audit Committee and our full Board regularly receives reports from our Chief Information Security Officer on, among other things, assessments of risks and threats to our security systems and processes to maintain and strengthen information security systems. Our Chief Information Security Officer also meets with the Audit Committee at least annually in executive session without other members of our management present. 25 2022 Proxy Statement | | | |

TABLE OF CONTENTS Board and Committee Information During 2021, our Board met eight times. Each of our directors attended at least 75% of the total meetings of our Board and the Board committees on which he or she served. Consistent with the expectations in our Corporate Governance Guidelines, each of our directors attended our 2021 annual meeting of shareholders. The table below provides the current membership of each of the standing Board committees. | | Kapila K. Anand | | | | | | | | | | | | | | | | | | | John P. Bilbrey | | | | | | | | | | | | | | | | | | | William F. Doyle | | | | | | | | | | | | | | | | | | | Scott D. Ferguson | | | | | | | | | | | | | | | | | | | Art A. Garcia | | | | | | | | | | | | | | | | | | | Michael J. Harrington | | | | | | | | | | | | | | | | | | | Paul Herendeen | | | | | | | | | | | | | | | | | | | R. David Hoover | | | | | | | | | | | | | | | | | | | Deborah T. Kochevar | | | | | | | | | | | | | | | | | | | Lawrence E. Kurzius | | | | | | | | | | | | | | | | | | | Kirk P. McDonald | | | | | | | | | | | | | | | | | | | Denise Scots-Knight | | | | | | | | | | | | | | | | | | | Jeffrey N. Simmons | | | | | | | | | | | | | | | | |

Chairperson Chairperson  Member Member26 2022 Proxy Statement | | | |

TABLE OF CONTENTS BOARD COMMITTEES Audit Committee | | Members

Kapila K. Anand (Chair)

John P. Bilbrey

Art Garcia

| Key Responsibilities

Assist our Board in its oversight of:

•the integrity of our financial statements and any other financial information which is provided to our

shareholders and others;

•the independent auditor’s qualifications and independence;

•the systems of internal controls and disclosure controls which our management has established;

•the performance of our internal and independent audit functions;

•our compliance with legal and regulatory requirements;

•the political, social, and legal trends and issues, and compliance and quality matters that may have an

impact on our business operations, financial performance or public image;

•our compliance with corporate policies and practices that relate to public policy; and

•information security and data privacy matters as it relates to financial reporting and internal controls.

The Audit Committee is also directly responsible for the appointment, compensation, retention, and

oversight of our independent registered public accounting firm.

The Audit Committee has established policies and procedures for the pre-approval of all services

provided by the independent registered public accounting firm. The Audit Committee has also

established procedures for the receipt, retention and treatment, on a confidential basis, of complaints

received by Elanco regarding its accounting, internal controls, and auditing matters. Further details of

the role of the Audit Committee, as well as the Audit Committee Report, can be found in “Proposal

No. 2: Ratification of Selection of Independent Auditor” below.

The Audit Committee’s charter is available on our website at www.elanco.com/en-us/about-us/

governance/corporate by clicking on the “Audit Committee Charter” link.

| | | | Our Board has determined that each member of the Audit Committee is independent within the meaning of our independence standards and applicable rules and regulations of the U.S. Securities and Exchange Commission (the “SEC”) and applicable NYSE listing standards. Each member is also financially literate, and Ms. Anand qualifies as an “audit committee financial expert.”

Meetings in 2021: 9 |

27 2022 Proxy Statement | | | |

TABLE OF CONTENTS Compensation Committee | | Members

Lawrence E. Kurzius

(Chair)

R. David Hoover

Kirk P. McDonald

Denise Scots-Knight

| Key Responsibilities

•Assist our Board in its oversight of our management compensation policies and practices, including determining and approving the compensation of our executive officers and overseeing our compensation plans, including by reviewing and approving incentive compensation and equity compensation policies and programs.

•Review our compensation program for Non-Employee Directors.

•Review the Elanco stock ownership of executive officers and, if appropriate, establish and oversee stock ownership and/or retention guidelines for executive officers.

•Annually review and report to our Board on the succession plans and leadership development for the Chief Executive Officer position and other executive officer positions, including a broad review of our succession management.

•Evaluate our performance in the area of diversity in our workforce.

Each Compensation Committee member is a “non-employee director” as defined in Rule 16b-3 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”).

The Compensation Committee’s charter is available on our website at www.elanco.com/en-us/

about-us/governance/corporate by clicking on the “Compensation Committee Charter” link.

Compensation Committee Interlocks and Insider Participation: During 2021 and as of the date of this Proxy Statement, none of the members of the Compensation Committee was or is an officer or employee of Elanco, and none of our executive officers served or serves on the compensation committee or board of directors of any company that employed or employs any member of our Compensation Committee or Board.

| | | | Our Board has determined that each member of the Compensation Committee is independent within the meaning of our independence standards and applicable NYSE listing standards.

Meetings in 2021: 6 |

Finance and Oversight Committee | | Members

John P. Bilbrey (Chair)

William F. Doyle

Scott D. Ferguson

Art Garcia

Paul Herendeen

Jeffrey N. Simmons

| Key Responsibilities

Assist our Board in its oversight of:

•certain of our financial policies, plans, and transactions, including mergers and acquisitions (including

the effective integration of acquired businesses), divestitures, and strategic partnerships, and capital,

foreign exchange and debt transactions;

•matters of balance sheet management, capital structure, leverage and financial strategy; and

•our progress towards achieving our margin, growth and operational goals.

The Finance and Oversight Committee’s charter is available on our website at www.elanco.com/en-us/

about-us/governance/corporate by clicking on the “Finance and Oversight Committee Charter” link.

| | | |

Meetings in 2021: 5 |

28 2022 Proxy Statement | | | |

TABLE OF CONTENTS Innovation, Science and Technology Committee | | Members

Deborah T. Kochevar (Chair)

William F. Doyle

Michael J. Harrington

Kirk P. McDonald

Denise Scots-Knight

| Key Responsibilities

Assist our Board in its oversight of:

•our strategy, activities, results and investment in research, development, external innovation/business development and innovation initiatives; and

•strategic, tactical and policy matters related to science and technology and any changes to the development and regulatory landscape.

The Innovation, Science and Technology Committee’s charter is available on our website at www.elanco.com/en-us/about-us/governance/corporate by clicking on the “Innovation, Science and Technology Committee Charter” link.

| | | |

Meetings in 2021: 5 |

Nominating and Corporate Governance Committee | | Members

R. David Hoover (Chair)

Deborah T. Kochevar

Kapila K. Anand

Lawrence E. Kurzius

| Key Responsibilities

Assist our Board in its oversight of:

•recommending qualifications required for membership on our Board and its committees;

•identifying and recommending candidates for membership on our Board and its committees;

•developing and recommending criteria and policies relating to the services of directors; and

•overseeing matters of corporate governance, including review of activities and practices regarding ESG

issues.

The Nominating and Corporate Governance Committee’s charter is available on our website at

www.elanco.com/en-us/about-us/governance/corporate by clicking on the “Nominating and Corporate

Governance Committee Charter” link.

| | | | Our Board has determined that each member of the Nominating and Corporate Governance Committee is independent within the meaning of our independence standards.

Meetings in 2021: 4 |

29 2022 Proxy Statement | | | |

TABLE OF CONTENTS Our relationship with our shareholders is an important part of our success. We are engaged in active discussions with our shareholders to facilitate investor understanding around a broad range of subjects, such as strategy initiatives, business performance, corporate governance, risk and compensation practices, and other ESG metrics. We believe this approach to engagement drives increased corporate accountability, improves our decision making, and ultimately helps create long-term value. We pursue multiple avenues for shareholder engagement, including video and teleconference meetings with our shareholders and issuing periodic reports on our activities. During 2021, we continued our extensive outreach efforts through an integrated team featuring our President and Chief Executive Officer, Chief Financial Officer, General Counsel and Corporate Secretary, Head of Investor Relations, and senior leaders in our Human Resources department. In addition to our regular outreach efforts, in the fourth quarter of 2021, we held a series of meetings with many of our institutional shareholders specifically focused on ESG performance and disclosure. As part of this, we initiated outreach to investors representing an aggregate of approximately 63% of our outstanding shares, and subsequently met with investors representing an aggregate of approximately 45% of our outstanding shares. Several of our directors, including the Chairman of our Board, engaged with investors as part of these discussions. Through these discussions, we discussed and received input and addressed questions on our corporate strategy, executive compensation program, and governance practices. These engagement efforts allowed us to better understand our shareholders’ priorities and perspectives and provided us with useful input concerning these topics. Shareholder and other stakeholder feedback is regularly communicated to the Nominating and Corporate Governance Committee and the Compensation Committee and is integrated into Board and committee discussions and decisions. This feedback is used, in part, to determine whether enhancements to our policies and practices are desirable to meet shareholder expectations to address new issues or emerging trends, such as those described in “—Recent Corporate Governance Enhancements” above. Below is a summary of certain feedback we received through our 2021 shareholder engagement program and how we responded. | | Board Composition: Would like to see continued focus on our priorities for future director recruitment and better understand our efforts to increase director gender and ethnic diversity. | | | • | | | We discussed our recent Board refreshment, which included eight new independent directors since 2019. | | | | • | | | We shared investor feedback with the Nominating and Corporate Governance Committee. | | | | • | | | We provided substantial disclosure in this Proxy Statement regarding the composition of our current Board and the skills and characteristics we consider important for our directors to have, as well as our process for identifying and evaluating director candidates. | | | | Corporate Governance: Would like to see us continue to evolve our Board structure and governance practices to enhance accountability to shareholders. | | | • | | | We adopted a “proxy access” bylaw whereby, beginning with the 2023 Annual Meeting, a shareholder, or group of up to 20 shareholders, owning 3% or more of our outstanding common stock continuously for at least three years, can submit director nominees for up to two individuals or 20% of our Board (whichever is greater) for inclusion in our proxy statement subject to certain customary limitations. | | | | • | | | We are submitting two management proposals, for shareholder approval at the Annual Meeting, to eliminate the supermajority provisions in our Articles of Incorporation and certain other legacy provisions (Proposal No. 5 and Proposal No. 6). | | | | • | | | We will continue to evaluate whether further enhancements to our policies and practices are desirable to meet shareholder expectations to address new issues or emerging trends. | | | | ESG Metrics: Appreciated the publication of our 2020 ESG Summary Report as strong progress but would like to see continued focus on setting targets, tracking ESG and human capital metrics and showing progress. | | | • | | | We have worked, and are continuing to work, to improve our data collection practices and enhance our public disclosures on our ESG efforts. We expect to continue aligning our disclosures with widely-adopted external frameworks, such as SASB and TCFD. | | | | • | | | In our 2021 ESG Summary Report, which we expect to publish later this year, we intend to provide more information on progress made in the prior year and introduce targets for key metrics. | |

30 2022 Proxy Statement | | | |

TABLE OF CONTENTS | | ESG Governance: Would like to see more disclosure around how our Board oversees ESG, including with respect to human capital management and culture. | | | • | | | We added more information to this Proxy Statement about our Board processes for overseeing ESG and other risk-related activities. See “—Board Oversight” above and “—Sustainability and ESG Program—ESG Program Governance” below for more details. | | | | • | | | We intend to provide more information in our 2021 ESG Summary Report, which we expect to publish later this year, on our Board’s approach to oversight of these matters. | |

Sustainability and ESG Program We are committed to being a unique force for good for all in society, and we believe that starts with animals. Our approach to sustainability – called Elanco’s Healthy Purpose™ – is a framework of commitments and actions focused on advancing the well-being of animals, people, and the planet. Elanco’s Healthy Purpose is built on the four interconnected pillars of Healthier Animals, Healthier People, Healthier Planet, and Healthier Enterprise, which represent the areas that we believe are most important to our customers, employees, investors, and other stakeholders, helping to bring to life sustainable solutions for generations to come. In October 2020, we launched our 2030 sustainability commitments aligned to the 2030 United Nations Sustainable Development Goals (SDGs) – the Elanco Healthy Purpose Pledges: Protein Pledge, Planet Pledge, and Pet Pledge. We are progressing our pledges and expect to include updates on our efforts in our 2021 ESG Summary Report. ELANCO’S HEALTHY PURPOSE: OUR APPROACH TO SUSTAINABILITY We are driving a Healthier Enterprise by managing our own environmental footprint and governing our business with the highest ethical standards, while creating a space where all employees feel safe, respected, empowered, and invested to make a difference in society. ESG PROGRAM GOVERNANCE Our Board and senior leadership have identified Elanco’s Healthy Purpose, including our sustainability and ESG efforts, as an important priority for Elanco. Leadership from across Elanco guides these efforts, including through our Executive Committee and employee-led committees related to our ESG program, diversity, equity and inclusion (“DEI”) initiatives, employee health and safety, and other matters. Our ESG program is led by a cross-functional steering committee, which is chaired by Marcela A. Kirberger, our Executive Vice President, General Counsel and Corporate Secretary, and which includes senior representation from our business and our Communications, Finance, Investor Relations, Regulatory and Supply Chain functions. This steering committee meets regularly and, among other obligations, is charged with reviewing our ESG program and monitoring progress against our ESG commitments and targets. This steering committee is also responsible for oversight of the production of our annual ESG summary report. 31 2022 Proxy Statement | | | |